Ottawa Tech: Will History Point to Possible Futures? — Personal Research Notes

For a deeper dive on the topics discussed (and more), you may wish to look through the following background research notes (includes over 100 web links curated from a diversity of sources).

Past Presentations

June 27 2023 (TiE Ottawa Chapter Dinner) — Unveiling Ottawa’s Tech Legacy: Tracing the Roots of Innovation Back 75 Years!

July 5 2022 (Wesley Clover Tech Tuesday) — 75 Years of Ottawa Tech (Yes!), and What Might Lie Ahead

Link to Video of Presentation (Youtube)

Presentation Summary:

It may not be a well-known fact but Ottawa’s tech scene came into being almost a decade (Computing Devices Canada, 1948) before Silicon Valley’s legendary Fairchild Semiconductor started up in 1957. In this presentation, Luc will draw the long arc of Ottawa’s ascendency as a tech hub of global importance and offer a retrospective on key events and personalities that shaped its evolution. The talk will cover the three principal historical eras of tech in Ottawa interspersed with vignettes of lesser-known stories that characterize local ingenuity and entrepreneurial spirit. The presentation will conclude with some thoughts on how Ottawa’s unique history can yield actionable insights about the future prospects for our city’s innovation ecosystem.

July 28 2021 (Bytown Museum) — Beyond Bytown: The History of Ottawa’s Tech Sector

The History of Ottawa’s Tech Sector (video recording on Youtube)

On the 28th of July 2021, we sat down with Luc Lalande (Founder, Aletheia Guild) to discuss the history of the technology sector in Ottawa.

Luc is passionate about Ottawa’s research and technology-based ecosystem (government, university and industry) and has observed the high and low points of the city’s evolving tech sector. He offered a wide-angle yet nuanced perspective on the past, present and future of Ottawa’s tech sector.

Luc was joined by Rob Woodbridge for the discussion part of the Lecture. Rob is the founder of Trexity and a 30-year Ottawa startup veteran as a founder, CEO, COO, advisor and mentor.

The presentation slides are viewable on SlideShare and the recorded talk on Youtube.

Part 1 — Describes three principal eras characterizing the evolution of the Ottawa tech industry and related spillover effects.

Part 2 — Critical discussion regarding the history, current status and future outlook of the city’s tech industry (scroll halfway down this post)

Part 1–The 3 Eras of Ottawa Tech

1st era of tech in Ottawa driven by the strength of both Federal government-led research (i.e., Defence Research Telecommunications Establishment (now known as the Communications Research Centre), the Defence Research Board (1947–1977) and National Research Council of Canada) and private R&D (especially the decision by Northern Electric and Manufacturing Company to concentrate its R&D efforts in the nation’s capital). Equally important is the establishment of the Atomic Energy of Canada Limited (1952) leading to the creation of Kanata-based Nordion and Theratronics.

Influential Events and Spillover Effects of R&D Era:

Establishment of Northern Electric R&D Laboratories site at Carling and Moodie (1959–61); creation of Bell-Northern Research (1971); Microsystems International (1969–1975) previously known as the Advanced Devices Centre of Northern Electric). The principal spillover effects were a) the attracting of top talent especially in the 60’s and 70’s to work on cutting edge technology; b) the “network effects” of connecting people to ideas and ideas to people (Terry Matthews/Michael Cowpland, JDS Fitel founders, John Roberts, Adam Chowaniec, Des Cunninghan and Colin Patterson, Dick Foss and Robert Harland, etc); and c) the emergence of the first wave of visionary market-driven tech entrepreneurs (in the 1970s and 1980s many of which reaching critical mass within a decade).

To get a sense of the fascinating back stories associated with these pioneering companies, I highly recommend Matt Roberts’ long form piece on Microsystems International Ltd.

Notable companies — Ontario Hughes-Owens Company (1942), Sperry Gyroscope Ottawa Limited (1940s), Mechron Engineering (1947), Computing Devices of Canada (1948), Electronic Materials International Ltd (195?), Northern Radio Manufacturing Company (1954), Instronics Ltd (1956), Guildline Instruments (1957), Leigh Instruments (1961), Systems Dimensions Limited (1968), Alphatext (1969), Quasar/Cognos (1969), Telesat (1969), Epitek Electronics (1969), Lumonics (1971), Gandalf Technologies (1971), Norpak (1972), Mitel (1973), Dynalogic (1973), HiTech Canada Ltd (1973), Canadian Astronautics Limited (1974), SHL Systemhouse (1974), Mosaid (1975), Siltronics (1975), Northern Telecom (1976), Prior Data Sciences (1977), Dipix Systems (1978), DY-4 Systems (1979),

Quantum Software Systems/QNX (1980), JDS Optics (1981), Med-Eng Systems (1981), NABU (1981), Orcatech Inc (1981), JetForm (1982), Calian Technologies (1982), ARTECH Studios (1982), i-STAT (1983), Fulcrum Technologies (1983), Calmos Semiconductor/Tundra Semiconductor (1983), Domus Software (1983), Cadence Computer/Kinaxis (1984), Corel (1985), OZ Optics (1985), Newbridge (1986), Object Technology International (1987). Also notable, arrival of Digital Equipment Canada sales office (Denzil Doyle, 1962) growing into Kanata’s largest employer by 1972.

Golden Age, Boom & Bust (1979–2001)

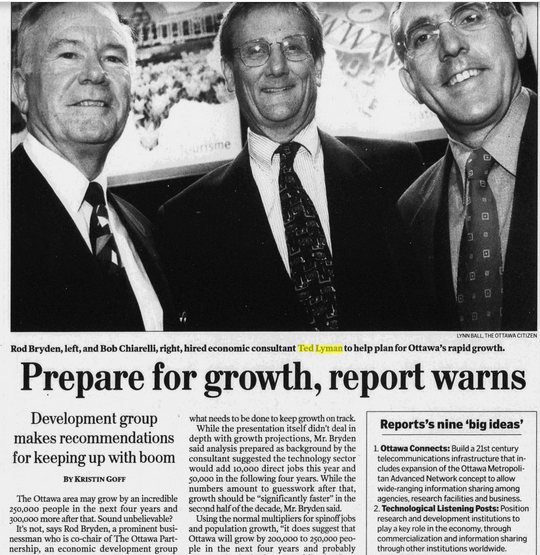

As early as 1981 major news media sources in the US (New York Times, Christian Science Monitor) began to take notice of Ottawa’s emergence as a tech hub and advanced center of research. By then there were roughly 100 high-technology companies employing between 15,000 to 20,000 people in Ottawa. In 1991, the number of Ottawa tech firms had reached 350 employing at least 25,000 workers. By the end of this era, there were about 1,000 tech companies located in the city employing roughly 72,000 people.

Also noteworthy is the creation of the 14-member Ottawa-Carleton Research Institute (OCRI) in 1983/84, renamed the Ottawa Centre for Research and Innovation (1998) and renamed again in 2011 as the Ottawa Centre for Regional Innovation.

In 2001, the Ottawa Economic Development Corporation (est. 1996) and formerly known as the Ottawa-Carleton Commercial and Industrial Development Corporation/OCEDCO) was merged into OCRI.

The Ottawa Life Sciences Council (est. 1994) was absorbed by OCRI in 2006 to unify economic development for the City of Ottawa. In 2012, OCRI itself was renamed as Invest Ottawa and forced to become a non-membership based organization focusing on investment attraction and business retention/expansion.

Of special note, in 1992 Ottawa became the first region in Canada, and one of only a few handfuls in the world, to offer a non-profit community computer network known today (and still going strong) as the National Capital Freenet.

1992 was also the year that the Newbridge Affiliates program was launched. At its time, the Newbridge Affiliates program was considered an innovative market-driven corporate venturing program that resulted in at least 20 companies employing over 1,500 people and generating combined revenues greater than $200 million.

One interesting vignette of Ottawa’s tech history was the breakthrough innovations in computer animation technology developed by a trio of NRC scientists (Nestor Burtnyk, Ken Pulfer and Marceli Wein) whose work led to an Academy Award for technical achievement (see image/story below). Despite the technology being developed in Ottawa’s NRC labs it was other cities in Canada including Vancouver (animation and visual effects), Montreal (video gaming) and Toronto (digital media, gaming and entertainment) that were able to apply these advances in computer-generated graphics/human-computer interaction and generate spillovers that evolved and grew into successful clusters in the creative industries. Another promising NRC-developed technology with broad applications in the creative industries (3D scanning) was mired in bureaucratic red tape as Ottawa startup XYZ RGB Inc. attempted over a two-year period to license the technology from the agency.

The 2nd era is perhaps best known by a short-lived boom of VC-backed technology startups highlighted by Cisco’s $89.1M (US) acquisition of 40-person Skystone Systems in 1997. However, the period leading up to the boom was in the author’s opinion a “Golden Age” of tech in Ottawa with the founding of some of the region’s most recognizable tech companies including: JDS Fitel, JetForm, QNX, Calian, Fulcrum, Corel and Newbridge Networks among others.

Period also marked by increased M&A activity involving Ottawa-based tech companies. Notable acquisitions: Nortel Networks buying Cambrian Systems for US $300M in 1998; PMC-Sierra, acquiring fabless semiconductor company 60-employee Extreme Packet Devices for shares with a value of approximately $415M (US$) in 2000; Conexant’s purchase of Philsar Semiconductor for $186M (2000); and the acquisition of Newbridge Networks by Alcatel in a stock deal pegged at $7.1 billion (also in 2000).

Unprecedented levels of venture capital investment in Ottawa during this era. Between 1996 and 2002, investment in the Ottawa region represented 38 percent of the total amount of VC invested in Ontario-based firms but declined sharply by 2002. An indication of venture capital’s growth in Ottawa was the popularity of the OCRI hosted Ottawa Venture Fair (renamed to the Ottawa Venture and Technology Summit from 1997–2009).

Influential Events and Spillover Effects:

The 1997 Skystone acquisition by Cisco literally put Ottawa on the tech startup map (e.g., direct flights from Ottawa to San Jose in the heart of Silicon Valley). Also, Nortel’s 1998 “right-angle turn” initiated by CEO John Roth from telecom to the Internet market exemplified by Nortel’s ($9.1B) acquisition of Bay Networks in 1998 and startups such as Xros ($3.2B) and Qtera ($3.0B). Startups (often with no product or revenue) being acquired at big ticket prices or attracting unprecedented venture capital investment in Ottawa ($1B in 2000). The unsuccessful attempt to attract a multi-billion-dollar microchip wafer manufacturing plant (Taiwan-based Mosel Vitelic) in Ottawa.

Lost Decades and Fresh Founders (2002–2022?)

The bursting of the dot-com bubble and subsequent recession in the US impacted Ottawa’s boom period with a vengeance.

“… because of a resulting glut of fiber in the years after the dot-com bubble burst, there was a severe overcapacity in bandwidth for internet usage that allowed the next wave of companies to deliver sophisticated new internet services on the cheap.” — Excerpted from How the Internet Happened: From Netscape to the iPhone by Brian McCullough.

Post-bust effects: laid-off Nortel staff launching communication networking startups (optical, wireless, broadband). VC investments in Ottawa tailing off by 2002. Ottawa photonics cluster failure to launch as the global market for fiber optic networks loses glimmer. More rigorous studies of the job cuts during this period (one reliable source stating the local tech sector lost 27,000 net jobs between the peak and 2005) indicated that smaller firms (including startups) did not absorb laid-off high-tech workers. One Stats Can report even stated that “two in five laid-off high-tech workers left the city.”

Notable companies — Entrust Technologies, Solinet System (Ceyba); Innovance Networks; Zenastra Photonics; Philsar Electronics, Meriton Networks; Trillium Photonics, OneChip Photonics, BTI Photonics, Edgeflow, Tellamon Photonic Networks, BelAir Networks; Tropic Networks, AcceLight Networks Canada, Akara, DragonWave, Extreme Packet Devices, EION, Zucotto Wireless, Liquid Computing, Catena Networks, SiGe Microsystems, Solidum Systems, BitFlash, Innovative Fibers, Bridgewater Systems, WebHancer, Watchfire, SiberCore Technologies, Sybarus, Sedona Networks, Quake Technologies, Atsana Semiconductor, MetroPhotonics, Lantern Communications, IceFyre Semiconductor, WorldHeart Corporation, SS8 Networks, Sedona Networks …

3rd era characterized by a) the long-term fallout of Nortel’s collapse; b) a slew of acquisitions of once promising local startups (see image below); c) the failure of other regional technology clusters (biotech, photonics, wireless, digital media, cleantech, cybersecurity, etc) to attain global industry prominence and d) a new wave of entrepreneurial venturing decoupled from Ottawa’s historical R&D and telecom industry roots (Shopify generation/Fresh Founders). Another interesting perspective is the significant lack of entrepreneurial venturing following the acquisition of Ottawa-based tech companies by large multinationals (i.e., IBM acquiring Cognos in 2007) and especially following the purchase of Nortel’s remnants by Ericsson, Avaya, Ciena and Genband (2009–2011). Jim Bagnall’s three-part series “Tech’s Vanishing Act” published in the Ottawa Citizen in 2011 offers an excellent analysis of this period.

“In the past few years a stunning number of the city’s public tech companies have either folded or been acquired, often by foreign suitors. The result: fewer home-grown stars that give a tech cluster its edge” — James Bagnall

Influential Events and Spillover Effects:

Nortel “stock” implosion in 2000 and subsequent corporate disintegration/in wider context of Internet bubble burst/dot.com crash of 2000. Nortel’s 16 rounds of layoffs until 2009 bankruptcy.

In 2001, the huge optical boom came to a crashing end. Network operators had drastically overbuilt global fiber capacity during the dot-com bubble, and it would be years before spending on optical transport equipment would fully rebound.

Age of the “fresh founders” and Shopify’s 2015 Initial Public Offering (IPO)

Notable companies — Halogen (1996), Pythian, Espial, Macadamian, and TravelPod (1997), SolaCom Technologies (1998), Fuel Industries (1999), Sigpro Wireless (2000), Spotwave Wireless (2000), Pleora Technologies (2000), BreconRidge (2001), Klipfolio (2001), Solace (2001), PointShot Wireless (2002), Diablo Technologies (2003), Third Brigade (2004), DNA 11 (2005), Assent Compliance (2005), Spartan Bioscience (2005), jaded Pixel/Shopify (2005), 360pi (2007), D-TA Systems (2007), YOUi Labs (2007), ChideIT/Fluidware (2008); Blindside Networks (2008), Cliniconex (2009), Solink (2009), Nuvyyo (2010), Giatec Scientific (2010), Fullscript (2011), Rockport Networks (2012), Ranovus (2012), Raven Telemetry (2013); PageCloud (2014), MindBridge Analytics (2015), Rewind (2015), Welbi (2016), RVezy (2016), GoFor (2016), Fellow.app (2017), BluWave-ai (2017), Replica Analytics (2019).

Are we on the cusp of a transitional shift to a 4th era in Ottawa tech?

What will be the principal spillover effects of the historic 2020 Pandemic? Does it represent a “discontinuous transformation” that will fundamentally alter the dynamics of the global innovation ecosystem? What will be the downstream effects of Work-From-Home/Work-From-Anywhere? Will a hybrid work environment and/or distributed workforce change the geography of “place-based” innovation and its effects on local knowledge spillovers? (i.e., “superstar” and “winner-take-most” cities; role of anchor companies/clusters/incubators/science & technology research parks and innovation districts). Will R&D-led innovation (especially business led R&D) which previously played such an instrumental role in establishing Ottawa as a global technology hub again feature prominently in the evolution of Ottawa’s tech industry? Will the “new wealth” play an influential role in diversifying and nurturing the next wave of visionary entrepreneurs and founders?

Part 2 — Critical discussion regarding the history, current status and future outlook of the city’s tech industry: How does Ottawa stack up?

There seems to be two divergent perspectives on where Ottawa presently stacks up with regards to the tech industry’s competitiveness and relative standing as a global technology hub. On the one side, there is a view that Ottawa had its “moment” and is no longer regarded as the country’s high tech epicenter (aka, Silicon Valley North) falling behind relative to urban centers such as Toronto-Waterloo, Montreal and Vancouver. On the other, there is a perspective that Ottawa/Kanata is experiencing a renaissance fueled by the ingenuity of a new generation of tech entrepreneurs and investment attraction in key technology sectors (i.e., autonomous vehicles, next generation networking equipment, 5G wireless infrastructure equipment, medical devices, precision agriculture, etc).

What do the data reveal? More significantly, which tech sector health indicators should we be devoting more attention to? Which ones are the most significant and insightful in terms of understanding how the Ottawa tech sector really stacks up?

Recent articles (Betakit, Sean Silcoff in Globe & Mail) point to a surging technology sector in Canada. For instance, the level of venture capital pouring into Canadian startups has already “crushed prior yearly records” only six months into 2021. How well is Ottawa faring relative to other urban centres during these recent boom times? Here are some noteworthy indicators:

Tech Employment numbers growth. Various agencies such as Invest Ottawa and Kanata North Business Association cite tech employment levels based on occupational surveys conducted by groups like CBRE where the number of tech employees (2019 estimate — 76,000 per Jim Bagnall) is tabulated no matter what industry they work in. Statistics Canada, on the other hand, adopts a narrower definition of “tech work” by counting those employees who actually work in industry sectors identified as technology-based using the North American Industry Classification System. The different methodologies yield very different counts of tech employment thereby skewing related indicators such as tech concentration/intensity.

One jarring statistic that demonstrates the rise of the GTA /Toronto as the leading tech hub in Canada (and North America) relative to Ottawa is the massive increase in tech jobs (as noted in CBRE 2022 Scoring Tech Talent) between 2016 and 2021. According to CBRE, Toronto added an astonishing 88,900 tech jobs over this 5-year period alone eclipsing Ottawa’s all-time total tech employment (81,200).

Tech companies counted in region. In 2011 OCRI reported a high of 1,944 companies in knowledge-based industries, slightly up from 1,819 OCRI reported in 2006, and up significantly from the 1,100 in 2001); Invest Ottawa currently reports 1,750 knowledge-based firms a number that has remained surprisingly unchanged since 2016 (per Invest Ottawa President’s 2016 Spring Report). Similar to the counting issues related to the number of tech employment, tabulating data on the number of tech companies in Ottawa has also been inconsistent. The Ottawa Business Journal 2011 Tech Industry Guide (image below), for example, lists roughly 1,250 companies as compared to the 1,944 reported by OCRI that same year.

Tech Concentration (in terms of % of workforce employed in tech). Education attainment levels per capita is another related metric. Depending on which tech employment statistics are used to calculate “tech concentration” (i.e., CBRE or Statistics Canada) the results are significantly different: 11.3% using CBRE baseline tech employment numbers or 6.4% based on Statistics Canada numbers. To put things in perspective, CBRE counts just over 80,000 tech jobs in Ottawa while Statistics Canada numbers are somewhere between 45,000 and 50,000.

Startup Ecosystem dynamism. Net growth and “churn” of startup ventures, startup density, share of employment in new and young firms, and ecosystem support networks (i.e., presence and dynamism of new/external incubators, accelerators, networking groups such as Founders Institute, Product Hunt, Startup Grind, F**kup Nights, TiE Ottawa chapter, The Ottawa Network, DemoCamp, Startup Weekend, etc.)

Venture Capital Activity — (as a share of) and total number of deals. By city, Toronto remained the most popular site of VC activity in 2020 with $1.2 billion across 164 deals and by Q2 2021 shattering the previous year’s total . This was followed by Montreal ($856 million), Vancouver ($767 million), and Calgary ($353 million). Ottawa is no longer in the top 5 (2020) with Q1 2021 results even worse. Ottawa is neither included in Hockeystick’s tech quarterly reports nor briefed.in’s trends reports.

Presence of Scale-ups/Unicorns — refers to the proportion of high growth potential tech companies in a geographical location. So far in 2021, 15 Canadian private technology companies have reached so-called “unicorn” status by achieving valuations of US$1-billion or more. A recent (2022, updated 2023) list (aka, “Team True North”) published by Communitech of high potential Canadian tech companies (i.e., on path to attain annual revenues of $1B) shows only 1 Ottawa-based company (Solink) out of the 41 identified.

Corporate Investment Attraction — new R&D centres, production and engineering hubs established by multinational tech companies. A review of the geographic locations of these offices (est. since 2016) clearly indicate Toronto as the top choice: Twitter (Toronto), Punchh (Toronto), Uber Technologies (2019, Toronto), Google expansion plans in Toronto, Waterloo and Montreal (2020), HSBC Global Data & Innovation Lab (Toronto, 2019), Pinterest engineering hub (Toronto, 2021), Netflix corporate office (Toronto, 2021), Wayfair engineering office (Toronto, 2021), Reddit, DoorDash and Cloudflare (Toronto, 2021), Samsung AI Centre (Toronto), Microsoft Reactor Program (Toronto, 2019), Stripe (Toronto, 2021).

Headquarter presence (in Ottawa) of Canadian tech firms. What is the effect of attracting HQs for a city? How has Ottawa fared in attracting HQs from other region? Will the pandemic alter decisions where to locate corporate HQs?

IPO Share — proportion of initial public offerings by Canadian tech companies. How many Ottawa-based tech companies are included in the recent surge of IPOs?

R&D and Patent Activity — Data from Research Infosource show that no Ottawa-based tech company cracked the top 10 R&D spenders in Canada (2020) although Shopify is close (11th). At the peak of the tech boom (2000) three Ottawa tech companies (Nortel, JDS, Mitel) made the top 10.

Diversification, growth and frontiers of tech-based clusters (biotech, photonics especially silicon-based photonics applications, biomedical and life sciences, SaaS, cleantech, cybersecurity, artificial intelligence, autonomous vehicles, etc). Note that centres of excellence in research, while a potential source of commercialization/spin-offs, do not necessarily lead to tech industry clusters.

Culture — “Paying it forward” (i.e., wealth, experience, networks and knowledge acquired by successful tech entrepreneurs re-deployed and re-circulated in the startup ecosystem). Are the networks associated with the Tech Tuesday events and Fresh Founders symbolic of “two solitudes” of Ottawa tech?

Emergence of “superstar cities” as innovation hubs —increasing regional inequalities “winner-take-all urbanism” as technology and innovation concentrate in cities with research strengths, industry density and large numbers of highly skilled graduates.

Innovation “Wins” (how Ottawa has fared in international/national/provincial innovation competitions?) such as the Amazon HQ2, Innovation Superclusters Initiative and Smart Cities Challenge; especially in the past 5–10 years.

External or Alternative References (aka, third party research reports on “innovative cities” such as the Global Cities Index, “startup ecosystems” and “VC investments/cities”. Also share of Ottawa-based companies in lists such as Branham Group, Deloitte Technology Fast 50, and general media coverage, etc). Other unconventional indicators might include how many Ottawa-based startups are invited to highly sought after startup incubator programs such Y Combinator. For instance, of the 16 Canadian startups participating at the Y Combinator Summer 2021 Demo Day not one was from Ottawa.

Other Indirect Indicators — Popularity of technology industry/startup events and ability to attract international visitors: Collision (30,000+ attendees, Toronto); Startupfest (7,000+ attendees, Montreal). Largest Ottawa-based tech events: SAAS North (~1,200 attendees), the now inactive AccelerateOTT (<1,000). Would hosting Shopify Unite in Ottawa generate buzz here?

Another indirect indicator was the level of media publishing related to the local technology sector. At one time, the Ottawa Citizen featured the “Tech Weekly”, “Tech Quarterly” and the Semi-Annual High Tech Report (left). Other media publications included “Silicon Valley NORTH” — Ottawa edition and National Capital SCAN. Ottawa Business Journal used to publish the Ottawa Technology Industry Guide (semi-annual then annual) and then later “Ottawa Technology” and the “High Tech Supplement”. The only remaining (and regular) media coverage on the Ottawa tech scene is the OBJ’s Techopia.

Tech-based Economic development initiatives led by local government and partners:

Regional Municipality of Ottawa-Carleton’s “Partners for the Future” (1992); National Research Council and Ottawa-Carleton Economic Development Corporation — Regional Innovation Forum (1996–merged with CATA’s Smart City Summit 2004); The Ottawa Partnership’s Economic Generators Initiative (1999); “Innovation Ottawa: A Strategy for Sustaining Economic Generators” — ICF Consulting (2002);

Ottawa-Gatineau Commercialization Task Force — OCRI (2003); Ottawa 20/20 Economic Strategy (approved by Council in April 2003); Global Innovation Hub Project — The Ottawa Partnership/OCRI (2006); Ottawa Innovation Strategy — OCRI (2009); Partnerships for Prosperity — City of Ottawa (2010); Bayview Yards Innovation Complex — City of Ottawa/Invest Ottawa (2013–14); Partnerships for Innovation — City of Ottawa; Economic Development Strategy Update (2015); Smart City 2.0 Strategy — City of Ottawa Planning, Infrastructure and Economic Development (2017); Ottawa 4.0 : Creating Global Market Advantage for Regional Impact— Invest Ottawa (2017); Capital Build Task Force (2018); New Official Plan: The Economy — City of Ottawa Planning, Infrastructure and Economic Development (2019); designation of Kanata North as a special economic zone (2020); creation of the Hub350 global technology centre by the Kanata North Business Association (2021);

Also note impact on Ottawa’s tech ecosystem resulting from provincial government innovation policy initiatives such as the (former) Ontario Commercialization Network and associated Regional Innovation Networks, the Ontario Network of Entrepreneurs (formely the ONE Program), the Ontario Research Commercialization Program (ORCP) and Regional Innovation Centres or RICs. On the Federal government side, programs such as the former Canada Accelerator and Incubator Program and the Scale Up Platform are noteworthy. Question: Do provincial/federal innovation policies/programs create unintended consequences such as distorting and crowding-out homegrown/local innovation efforts?

Engagement by Local Post-Secondary Institutions

Higher Education Institutions efforts to stimulate regional innovation such as the National Capital Institute of Telecommunications (NCIT — dubbed “MIT of the North”) in 1999–2000;

Carleton University

Campus-based entrepreneurship, innovation and research commercialization initiatives including: Celtic House Student Technology Venture Challenge, Foundry Program, Lead to Win, Hatch, Innovation Hub; Notable research groups with significant commercialization successes: Object Oriented Research Group (School of Computer Science), Department of Electronics, and Department of Systems and Computer Engineering.

University of Ottawa

Entrepreneurship Hub, Startup Garage, Simon Nehme Summer Entrepreneurship School, Entrepreneurial Ideas/Concepts competitions, Maker Launch, Entrepreneurship Co-op, Centre for Entrepreneurship and Engineering Design, Enactus. University of Ottawa Kanata North campus (launched 2019); Alacrity Ottawa chapter (Univ of Ottawa and Wesley Clover (2021). Notable spin-offs: World Heart Corporation, Liponex, Turnstone Biologics, Privacy Analytics, Spectalis, Sensor Cortek, DNA Genotek, Spyderwort and PanThera.

Greater collaboration (i.e., “Education City”) among academic, government and industry partners leading to innovation and entrepreneurship (Algonquin College, 2016); Have Ottawa post-secondary institutions contributed through visionary and exemplary innovation leadership? (for a reference example see Douglas Wright at the University of Waterloo).

Part 3 — Q&A (15min)

Samples questions (suggested by the Bytown Museum):

1. What do you think has been the most enduring legacy of the tech community’s contributions to the development of Ottawa as we know it today?

2. How can the history community and Ottawans, in general, ensure the proper recognition and appreciation of the tech sector’s roots in the area?

3. With respect to the first era of tech in Ottawa, R&D played a major role in its realization and success. In your opinion, does the future of Ottawa’s tech sector rely on or feature a return to research and development (R&D)? How crucial is R&D in not only establishing but maintaining the tech industry in Ottawa?

4. Does Ottawa being the capital impact the development of the tech sector and would you consider it a limitation or advantage in that development? What is unique about the tech sector in a capital city?

5. In the last year, we realized the feasibility and possibilities of hybrid work environments, with a work from anywhere approach. What do you believe are the effects of this shift in work culture on the tech sector, particularly on location-based development?